For individuals who have always wanted to acquire a home in Navi Mumbai, the CIDCO Lottery 2024 offers a glimmer of hope. This year's lottery promises a simpler route to affordable housing with a longer installment payment plan and new contact details for queries. In one of Maharashtra's most sought-after metropolitan cities, the CIDCO Lottery is your doorway to a better future, whether you're looking to resume blocked payments or explore new prospects. Speak with the CIDCO Nivara Kendra for all the assistance you require, then take the first move towards obtaining your ideal house right now.

CIDCO: What is it?

The Maharashtra government established CIDCO, or the City & Industrial Development Corporation of Maharashtra Limited, on March 17, 1970. They see themselves as the top town planning organization in the nation.

Offer physical and social services that raise living standards and reduce disparities in the amenities available to different sections of the population is their stated goal.

Stated differently, their goal is to give lower-class individuals and those living in the economically weaker sections access to reasonably priced residential and commercial real estate. These buildings are well-planned, environmentally friendly, and sustainable because the architects are town planners. They apply their knowledge.

To create an atmosphere that enables the people of New City to lead richer, more fulfilling lives, free from the social and physical conflicts that are typically connected to living in an urban setting, to the extent that this is feasible. To enable the current local people in the project area to adjust to the new urban environment and fully and actively engage in the social and economic life of the New City, we will offer them all the facilities and training they need.

Because CIDCO builds houses that support a better living for people who need it most—in addition to being affordable—they are in high demand. In the Taloja node in Navi Mumbai, CIDCO is currently accepting online registrations for 5730 houses in the general category and the economically weaker section (EWS).

Concerning the CIDCO Housing Programme

On January 26, 2024, the CIDCO Housing Scheme 2024 was formally introduced, providing Maharashtra with a new option for affordable housing. With this project, around 3,322 new homes will be built in Navi Mumbai's Taloja and Dronagiri nodes, which are renowned for their quick development and advantageous access to major transportation hubs like the Mumbai-Pune Motorway and the soon-to-be CIDCO Metro Project. In addition to being well-positioned for rapid expansion, these areas provide community centres, healthcare facilities, and educational institutions, among other necessities for a full urban experience.

The focus of this project is to provide the Economically Weaker Section (EWS) with inexpensive living spaces by offering a significant number of apartments at discounted prices. This is in accordance with the Chief Minister's directions to increase the accessibility of homes for lower-income families. The organization's goal of raising inhabitants' quality of life is carried out through the CIDCO flat lottery 2024, which strengthens its dedication to creating inclusive and well-planned urban communities in Maharashtra.

What is the lottery programme run by CIDCO?

In keeping with the objectives of the Pradhan Mantri Awas Yojana (PMAY), the CIDCO Home Lottery Scheme will continue to support the urban poor by offering affordable housing options through 2024. While CIDCO has extended its work beyond 2024, PMAY's goal of building 20 million affordable dwellings by March 31, 2023, has been surpassed. The company is now concentrating on building sustainable housing in Navi Mumbai's critical neighbourhoods, such as Panvel, Taloja, Kharghar, and Kalamboli, in addition to Bamandongri, Kharkopar, and Juinagar. Every year, CIDCO chooses new development areas, builds thousands of beautifully built homes at discounted prices, and distributes them to qualified recipients via a painstakingly planned lottery system, guaranteeing equitable housing access for those who require it.

Who Stands to Gain from the CIDCO Housing Programme?

The goal of the CIDCO Housing Scheme 2024 remains to assist economically disadvantaged people with their housing needs; it primarily targets the Lower Income Group (LIG) and Economically Weaker Sections (EWS) categories. Individuals from non-reserved categories who earn less than 8 lakhs per year as a family fall into the EWS category, whereas households earning between 3,00,001 and 6,00,000 per year fall into the LIG category.

Qualifications to Enter the CIDCO Lottery in 2024

A domicile certificate proving that you have been in Maharashtra for a minimum of 15 years is required in order to apply for the CIDCO lottery. It is not necessary for you to live in Navi Mumbai or the area where the housing is being built, but you must be a resident of Maharashtra and provide documentation to support your residency status.

In addition, you will require evidence of your income; if you are interested in an EWS flat through the CIDCO lottery, your salary should not exceed Rs 25,000. In order to be eligible for a flat under the LIG CIDCO lottery plan, you must provide evidence of your monthly income, proving that you earn between Rs 25,000 and Rs 50,000.

In order to ensure that the programme helps individuals in need in Maharashtra, candidates must meet stringent eligibility requirements in order to participate in the CIDCO Lottery 2024. Important prerequisites consist of:

Residence: To ensure that eligibility is valid throughout the state of Maharashtra and is not restricted to Navi Mumbai or particular project regions, applicants must have a domicile certificate attesting to a minimum of 15 years of residency in the state.

Income Requirements:

The monthly income of applicants for the Economically Weaker Section (EWS) category cannot be more than Rs 25,000.

The monthly income range for the Lower Income Group (LIG) category is Rs 25,000 to Rs 50,000.

These requirements are designed to direct the benefits of the housing plan towards the people and families in the area who most need assistance finding an affordable homes.

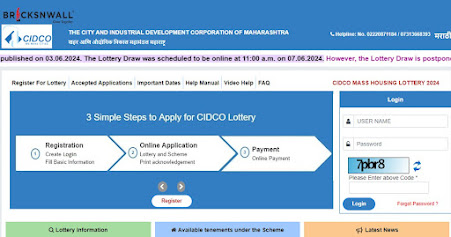

How to Register Online for the CIDCO Lottery Scheme in 2024

Open the following link to access the official CIDCO website: lottery.cidcoindia.com.

To begin the application process, select the "Register for lottery" option.

Fill out the CIDCO home application form, making sure you have your current address, Aadhaar card, PAN card, and bank account information on hand.

Upload the necessary files in the digital format that the website specifies.

Make sure your online application for CIDCO Homes is accurate and comprehensive by carefully reviewing it.

Once you've confirmed that the information is accurate, submit your application.

Proceed with the payment; the registration fee is Rs. 25,000 for candidates applying under the Lower Income Group (LIG) category and Rs. 5,000 for those applying under the Economically Weaker Section (EWS) category.

Choose a payment method from the list of choices, which includes credit/debit card purchases and online banking.

Required Documents for the 2024 CIDCO Lottery Scheme

The CIDCO Lottery Scheme 2024 application process is still simple, needing only the necessary documentation to guarantee hassle-free and seamless registration. Candidates need to submit the following paperwork:

Income Proof Certificate: This document attests to the applicant's income, which is necessary to establish if they qualify for the Lower Income Group (LIG) or Economically Weaker Section (EWS) programs.

Domicile Certificate: Verifies that the applicant meets the residence requirements of the scheme by attesting to their length of time of residency in Maharashtra.

An Aadhar card is a required form of identification that confirms the applicant's address and identity.

PAN Card: necessary for income verification and financial transactions.

Voter ID: An extra piece of documentation that can be used to verify an applicant's residency status.

Bank Information: Required to complete any lottery-related transactions, such as the application fee and, if applicable, the refund procedure

How can I view the CIDCO lottery results for 2024?

Once your application is complete, follow these steps to view the CIDCO Lottery 2024 results:

As you wait for the lottery results to be announced, keep in mind that there is frequently a large gap between the supply and demand of available properties.

To view the results section, go to the CIDCO website.

To find your particular outcome, enter the information of your application. For simpler navigation, you can narrow down your search by entering your scheme code and category.

If you need any additional support, call the CIDCO helpdesk at 022-62722255.

Refunds of the application money will be handled automatically, so applicants who are unsuccessful in the CIDCO Lottery 2024 don't have to give up. Refunds for credit or debit card purchases will be sent straight to the original account.

Refunds will also be sent by demand draft (DD) to customers who made their payment via DD.

Where are the CIDCO 2024 Flats located?

The following locations house the apartments for CIDCO 2021–2022:

- Taloja Bachandgri Jayandir

- Kharghar Palvel

- Kalamboli, Kharkopar

- These are developing areas in Maharashtra, with rapid development taking place and excellent access to Mumbai through buses and local trains.

How to proceed after winning the Covid Warrior Scheme lottery at CIDCO

Along with a collection of documentation that includes a PAN card, domicile certificate, income certificate/payslip, passport, voter's ID, birth certificate, driver's license, and school leaving certificate, the winner will receive a "First Intimation Letter" from CIDCO.

Upon receipt and verification of the required documentation, CIDCO will issue a "Provisional Offer Letter."

The chosen candidate will have a deadline for paying CIDCO a portion of the flat.

After paying CIDCO the entire cost of the apartment, the applicant will receive an allotment letter.

In addition to giving the CIDCO a copy of the registration certificate, applicants must pay stamp duty and registration fees on the property.

The applicant will receive a possession letter from CIDCO.

Can CIDCO flats be Sold?

The state government is thinking of allowing flat transfers in Navi Mumbai's CIDCO complexes. CIDCO flat recipients are currently prohibited from selling their allocations for a minimum of five years. Under the amnesty program, buyers who are granted power of attorney to transfer their CIDCO unit before the five-year period can now get the transaction legalized.

Service Fees for CIDCO

- Visit the following website: https://cidco.maharashtra.gov.in/citizenbillpayment/servicebill#gsc.tab=0 to cover CIDCO's service fees.

- Enter your customer number or UID, the captcha code, then click submit to continue with the payment.

- Please visit http://www.cidcoindia.com/estatescbill/page/searchconsumer.aspx if you are unsure of your customer number or UID. and enter it by typing.

- To obtain your consumer number or UID, enter your name, property UID, sector number, or node and click submit.

It should be noted that CIDCO clients can use the e-payment option for a variety of transactions, including service fees and water bills. However, CIDCO retains the authority to charge users for the service.

CIDCO Complaint Resolution

If you have a grievance over a CIDCO service, you can use the grievance redressal system. Online media is recommended by CIDCO for a prompt and efficient response. The chief grievance redressal officer (CGRO) is only accessible for meetings on Mondays and Thursdays from 2:00 pm to 5:00 pm.

Enter your password and citizen email address to log in, then enter the captcha text to finish the procedure. Make an account first if you don't already have one before continuing. You can make a complaint after logging in, and you'll receive a reference number.

CIDCO Contact Details

If you have any questions, go to –

Ground Floor, CIDCO Bhavan, Citizen Facilitation Centre, CBD Belapur.

Or make a call to –

022 67918174